What’s Happening?

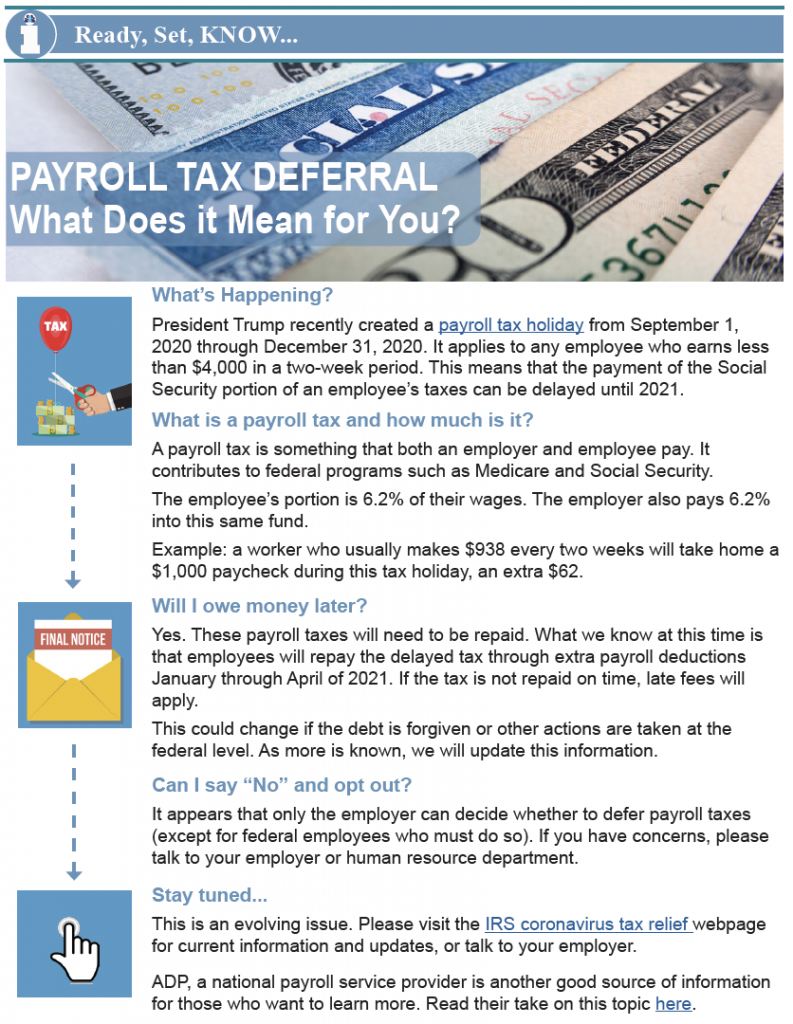

President Trump recently created a payroll tax holiday from September 1, 2020 through December 31, 2020. It applies to any employee who earns less than $4,000 in a two-week period. This means that the payment of the Social Security portion of an employee’s taxes can be delayed until 2021.

What is a payroll tax and how much is it?

A payroll tax is something that both an employer and employee pay. It contributes to federal programs such as Medicare and Social Security. The employee’s portion is 6.2% of their wages. The employer also pays 6.2% into this same fund.

A payroll tax is something that both an employer and employee pay. It contributes to federal programs such as Medicare and Social Security. The employee’s portion is 6.2% of their wages. The employer also pays 6.2% into this same fund.

Example: a worker who usually makes $938 every two weeks will take home a $1,000 paycheck during this tax holiday, an extra $62.

Will I owe money later?

Yes. These payroll taxes will need to be repaid. What we know at this time is that employees will repay the delayed tax through extra payroll deductions January through April of 2021. If the tax is not repaid on time, late fees will apply.

Yes. These payroll taxes will need to be repaid. What we know at this time is that employees will repay the delayed tax through extra payroll deductions January through April of 2021. If the tax is not repaid on time, late fees will apply.

This could change if the debt is forgiven or other actions are taken at the federal level. As more is known, we will update this information.

Can I say “No” and opt out?

It appears that only the employer can decide whether to defer payroll taxes (except for federal employees who must do so). If you have concerns, please talk to your employer or human resource department.

It appears that only the employer can decide whether to defer payroll taxes (except for federal employees who must do so). If you have concerns, please talk to your employer or human resource department.

Stay tuned…

This is an evolving issue. Please visit the IRS coronavirus tax relief web page for current information and updates, or talk to your employer.

ADP, a national payroll service provider is another good source of information for those who want to learn more. Read their take on this topic here.